Continuous development of your business is essential to strengthening your position in the marketplace. Business development comes in all kinds of forms, from expanding globally into new markets to simply investing in necessary equipment, such as a telephone and internet access, to aid the daily running of the business; both of which are very important. Investing in essential equipment and technology develops your business and leasing supports this development.

Leasing enables you to acquire the equipment your business needs without eating into your budgets. We can finance a wide range of capital equipment (costs £1,000+) for you, so why not give it a go and enjoy many benefits?

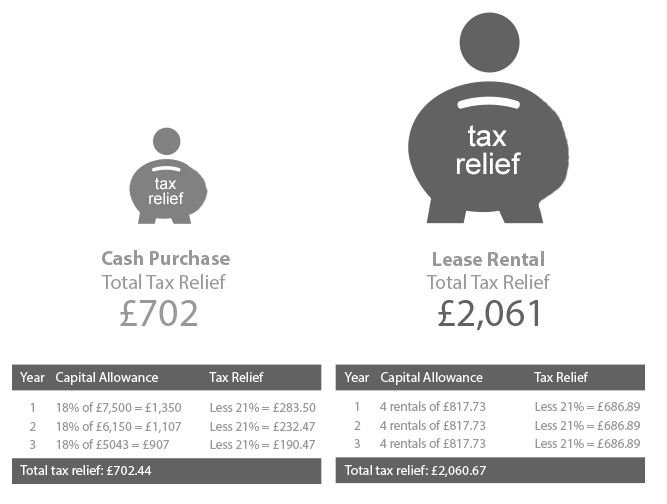

Equipment Cost: £7,500 - Lease Period: 3 Years - Frequency: Quarterly - Company's Tax Rate: 21%

Many of our customers who were new to leasing now only use this method of investment when obtaining equipment.

Here are some of the many reasons why:

As shown in our Lease v Buy example leasing enables companies to claim 100% tax relief. Complete the short form below to download our Tax Relief Fact Sheet, the document clearly explains the elements of the tax relief you will receive when leasing equipment for your business. There are clear examples and definitions so that you understand this fantastic benefit fully and feel 100% comfortable choosing to lease.

Leasing benefits your business now and far into the future. Contact us today for your personal lease proposal .

TCS CAD & BIM Solutions Limited is an appointed representative (introducer) through Ignition Credit Plc, Sterling House, Truro, Cornwall, TR4 9LF. Ignition are authorised and regulated by the financial conduct authority (FCA) under consumer credit licence number 569587. FCA FRN: 679018.